How University Endowments can fuel Tech Startups and empower communities by Volker Hirsch

In the rapidly evolving landscape of technology and innovation, universities play a pivotal role not just as educational institutions but as incubators of groundbreaking ideas. One of the most impactful ways universities can contribute to this ecosystem is through their endowments investing in tech startups. This strategy has been successfully employed by large U.S. universities like Harvard, Yale, and Stanford, and it’s time for UK universities—both large and small—to harness this potential.

The U.S. Model: A Blueprint for Success

Harvard University, with its endowment exceeding $50 billion as of 2023, has been an active investor in venture capital and private equity. By allocating a portion of its endowment to tech startups, Harvard not only achieves substantial financial returns but also fosters a culture of innovation that benefits its students and faculty.

Yale University follows a similar path and is the world’s second largest university endowment fund. Under the stewardship of the late David Swensen, Yale’s endowment strategy included significant investments in alternative assets, including venture capital. This approach has yielded impressive returns and supported the growth of numerous startups that originated from the university community.

Stanford University takes it a step further by being at the heart of Silicon Valley. Its endowment investments have historically included early-stage tech companies, many of which were founded by Stanford alumni or even current students. This symbiotic relationship has cemented Stanford’s reputation as a cradle of innovation.

The UK Perspective: Oxford and Cambridge Leading the Way

In the UK, Oxford and Cambridge universities have recognised the value of investing endowment funds into tech startups. Oxford Sciences Innovation (OSI), for instance, is a £600 million investment company that supports Oxford-affiliated startups in sectors like AI, biotech, and quantum computing. This initiative not only propels technological advancement but also contributes to the local economy by creating jobs and attracting further investment.

Similarly, Cambridge Innovation Capital (CIC) invests in IP-rich companies from the Cambridge ecosystem. By bridging the gap between research and commercialization, CIC has helped startups scale up, thereby reinforcing Cambridge’s position as a leading hub for technology and innovation.

The Ripple Effect: Benefits to Communities

When university endowments invest in tech startups, the benefits extend far beyond financial returns. Here’s how:

1. Economic Growth: Startups often require a workforce, leading to job creation in the local community. This stimulates economic activity and can revitalize surrounding areas.

2. Innovation Ecosystem: Investment fosters a culture of innovation, attracting talent, researchers, and additional investors to the university and its locale.

3. Educational Opportunities: Students gain hands-on experience through internships and collaborations with startups, enhancing their education and employability.

4. Global Impact: Technological advancements emerging from these startups can address global challenges, enhancing the university’s reputation on the world stage.

Empowering Smaller UK Universities: The Power of Collaboration

While Oxford and Cambridge have sizable endowments to independently support startup investments, smaller UK universities often lack the financial clout to make significant impacts alone. However, by **pooling resources**, these institutions can collectively participate in venture investments, reaping similar benefits.

Consortia and Investment Funds: Universities can form consortia to create joint investment funds dedicated to tech startups. This not only diversifies risk but also amplifies the available capital, making it possible to support more substantial and varied ventures.

Government and Private Partnerships: Collaborating with government initiatives and private investors can further augment the investment pool. Programs like the British Business Bank already support such partnerships, aiming to drive innovation and economic growth.

Shared Innovation Hubs: Establishing shared incubators and accelerators can create environments where startups thrive, benefiting from the combined expertise and resources of multiple universities.

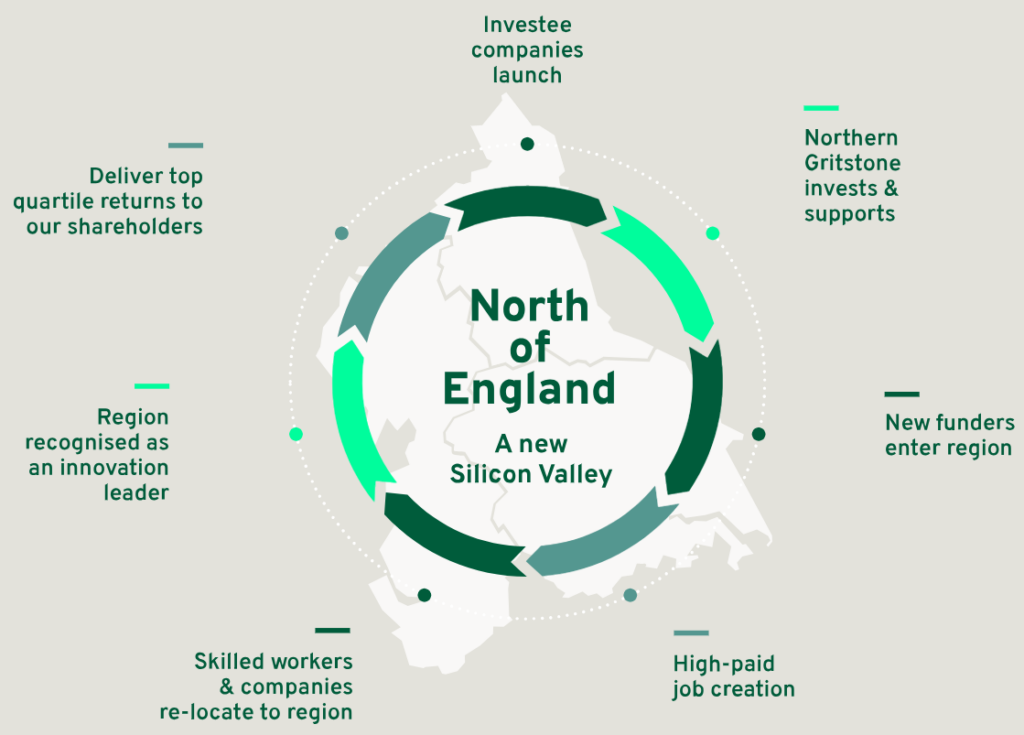

Case Study: The Northern Gritstone Initiative

Source: Northern Gritstone

An excellent example of this collaborative approach is the Northern Gritstone initiative, launched by the universities of Leeds, Manchester, and Sheffield. By pooling their resources, these institutions aim to commercialize university spin-offs in the North of England, focusing on sectors like advanced materials, health technology, and digital innovation. This initiative not only supports startups but also aims to rebalance the UK’s economy by stimulating growth outside the traditional tech hubs.

Conclusion

University endowments are more than financial safety nets; they are powerful tools that can drive innovation, economic growth, and societal progress. By investing in tech startups, universities can unlock a multitude of benefits for their communities and stakeholders.

For smaller UK universities, collaboration is key. By pooling resources and working together, they can emulate the successes of their larger counterparts and play a significant role in shaping the future of technology and innovation in the UK.

It’s time for universities across the UK to recognize this potential and take strategic steps toward investing in the innovators of tomorrow. The ripple effects of such actions will not only enrich the universities themselves but also empower communities, fuel economies, and contribute to solving some of the world’s most pressing challenges.

Call to Action

Our team at Advantage Creative is keen to support universities in the UK with initiatives to nurture entrepreneurship and innovation. With over two decades of experience, Advantage Creative brings deep knowledge in start-up investment and entrepreneurship support. Our track record in successfully developing and managing funds like the Advantage Creative Fund (ACF) showcases our credibility in the start-up investment ecosystem.

The particular innovations we developed which are relevant to University Endowments include:

- Pilot Fund: Allows testing and adaptation without long-term commitments, fostering flexibility and risk mitigation.

- Evergreen Fund: Embraces a patient, ROI-focused approach, reinvesting profits for continuous support, making it compatible with public funding.

- CIC Structure: Manages the fund as a Community Investment Company, emphasizing community benefit, transparency, and preventing profiteering.

">Reach out to our team to explore how we can collaborate, and help UK Universities unlock the resources at their fingertips to support innovation and entrepreneurship.

About the Authors:

Volker Hirsch is a passionate advocate for innovation and the transformative power of education. With a keen interest in technology and economic development, he writes about the intersections of academia, investment, and community growth.

Chat GPT provided valuable support in co-authoring this blog with Volker.